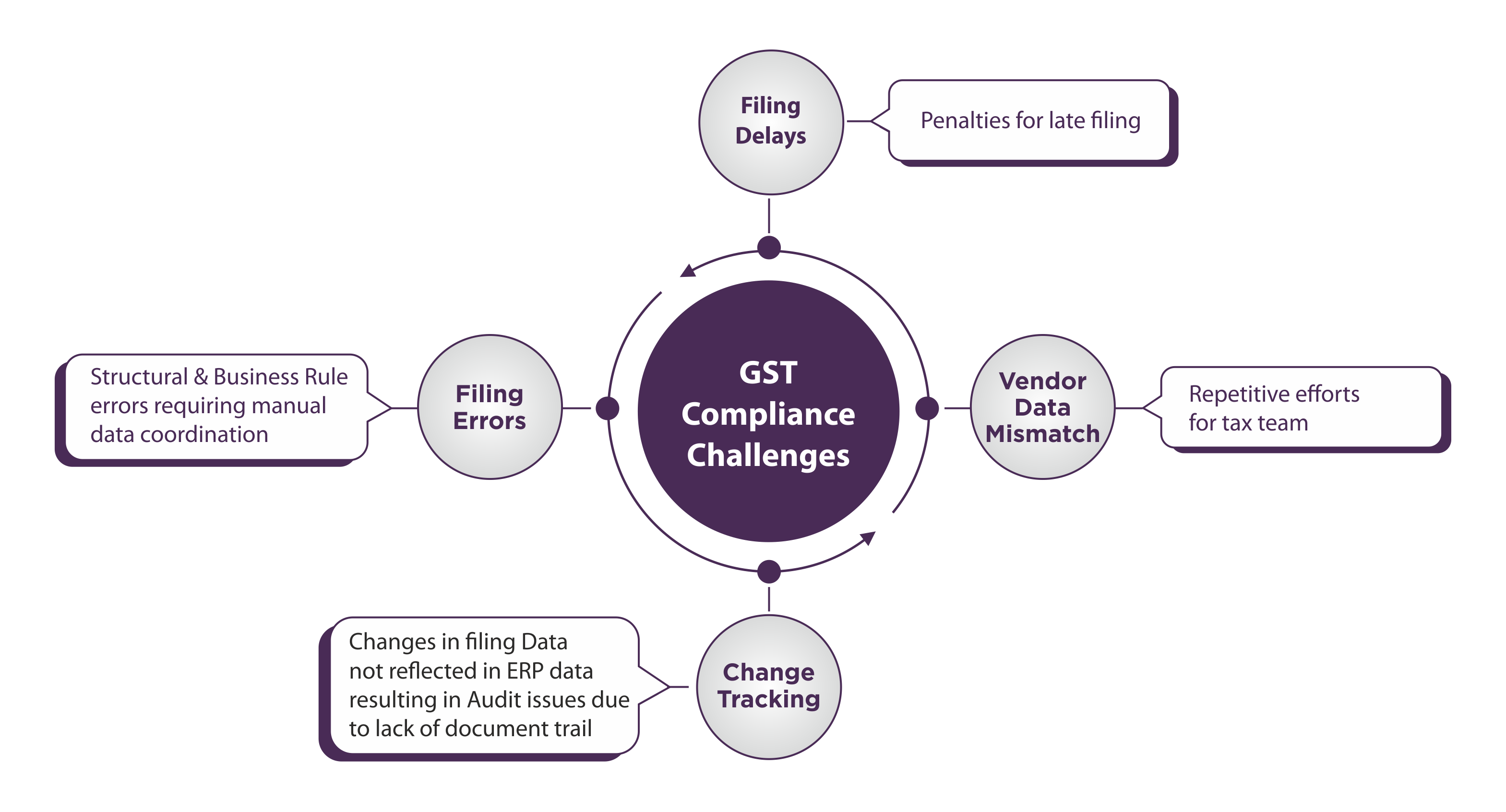

E-invoicing or ‘electronic invoicing’ is a system in which B2B invoices are authenticated electronically by GSTN for further use on the common GST portal. E-Invoicing will be applicable for organizations with a turnover of INR 500 Cr and above from 1st October 2020 onwards.

Highbar Technocrat Limited offers an Intelligent E-Invoicing Connector + GST Enhancer, compatible with any Government approved GSP solution providers and with the IRP portal, to assist organizations in being E-Invoicing compliant ON TIME.

Highbar’s Intelligent E-Invoicing Connector assists organizations to be E-Invoicing ready quickly and the GST Enhancer smoothens the existing GST filing process with error-free uploading, filing with greater accuracy, and optimized return on investment, with the following advantages:

- Quick deployment into the existing solution set

- Coexistence with any of the government-approved E-Invoicing & GSP solution providers.

- Predefined interface approach compatible with government released APIs for interfacing SAP with E-Invoicing solution provider (GSP)

- Solution ready with 4 different ways for updating invoice data to E-Invoicing solution provider portal –

- Direct upload to E-Invoicing solution providing portal (GSP)

- Batch upload of invoice data at the end of the day or at a predefined frequency on to E-Invoicing solution providing portal (GSP)

- Invoice data upload using the SFTP approach

- Real-time integration